In the ever-evolving landscape of cryptocurrency, new innovations continuously reshape how we think about digital assets and their potential applications. Among these groundbreaking concepts is RWA Crypto, an abbreviation for “Real-World Assets Crypto.” As the name suggests, RWA Crypto bridges the gap between the virtual blockchain world and tangible, real-world assets like real estate, commodities, or even fine art. But how exactly does this intersection of the physical and digital realms work? Let’s explore the key aspects of RWA Crypto, from its unique features to its future potential and how it’s transforming the traditional financial system.

What is RWA Crypto: Blurring the Lines Between Physical and Digital Assets

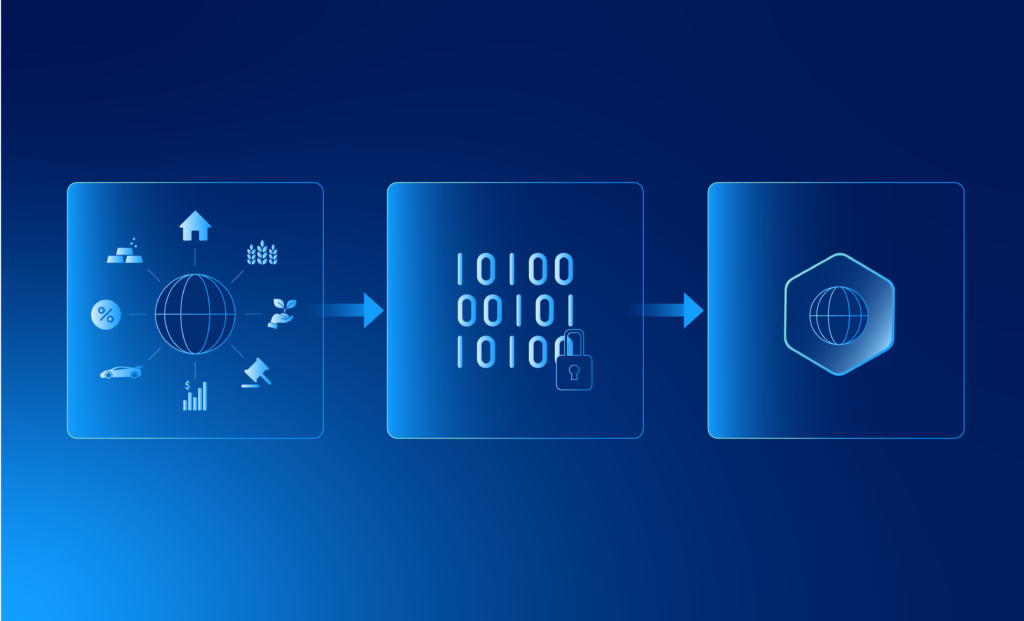

RWA Crypto refers to the tokenization of real-world assets on a blockchain. Essentially, physical assets such as property, gold, or even stocks are converted into digital tokens, which can then be traded, sold, or used as collateral in the decentralized finance (DeFi) ecosystem. The process of tokenization makes these assets divisible, transferable, and accessible on a global scale. This allows for greater liquidity and opens up investment opportunities for a wider audience.

One of the primary benefits of RWA Crypto is democratizing access to investment opportunities that were once reserved for institutional investors or the wealthy. For example, owning a portion of a luxury real estate property in another country or investing in a rare piece of artwork is now possible with the tokenization of these assets. This concept makes investing in high-value physical assets more affordable and accessible, allowing anyone with an internet connection to participate in the global economy.

Security and Transparency in the RWA Crypto Ecosystem

Security is always a concern when dealing with both physical and digital assets. One of the key features of RWA Crypto is its integration with blockchain technology, which ensures a higher level of transparency and security. Blockchain’s immutable ledger guarantees that each transaction is recorded and verified, making fraud or manipulation nearly impossible. Moreover, the decentralized nature of blockchain removes the need for intermediaries, reducing the cost of transactions and speeding up the entire process.

However, managing real-world assets on a blockchain also comes with its unique challenges. For example, there is the issue of asset verification. How can you ensure that the tokenized asset truly represents the physical item? In response, platforms that offer RWA Crypto often work with trusted third-party verifiers or auditors to ensure that the physical asset is properly valued, accounted for, and legally bound to the digital token. This combination of smart contracts and third-party verification ensures that the asset’s integrity is maintained within the blockchain system.

The Future of RWA Crypto: Expanding Use Cases and Global Implications

The potential applications of RWA Crypto extend far beyond just investment opportunities. The concept of real-world asset tokenization has implications for industries such as real estate, supply chain management, and even government systems. By digitizing and tokenizing assets, businesses can streamline their operations, making transactions quicker, cheaper, and more transparent. Imagine being able to track the ownership of a piece of land across borders or easily liquidating a portion of a commercial building without the usual red tape—these are some of the many promises RWA Crypto holds.

Moreover, as regulatory frameworks around blockchain and cryptocurrency evolve, RWA Crypto is poised to play a significant role in reshaping how traditional financial markets operate. Governments are already exploring how they can integrate blockchain into their systems for more efficient property management, digital identities, and tax collection. By creating a legally recognized digital version of real-world assets, RWA Crypto is positioning itself as a key player in the future of decentralized finance and global economic infrastructure.

Conclusion: Why RWA Crypto is the Future of Asset Management

RWA Crypto represents a revolutionary approach to blending the physical world with the digital, offering new investment opportunities, enhanced security, and more efficient transactions. By tokenizing real-world assets, RWA Crypto opens up avenues for greater financial inclusion and liquidity, making it a powerful tool in the world of decentralized finance. As industries continue to explore its possibilities and global regulations adapt, RWA Crypto is set to become a foundational element in the future of asset management and economic systems.